Managing your personal finances effectively is essential for achieving financial stability and reaching your financial goals. One powerful tool that can assist you in this endeavor is a budgeting app. In this article, we will explore the numerous reasons why you need a budget app to take control of your finances and improve your financial well-being.

1. Simplified Expense Tracking

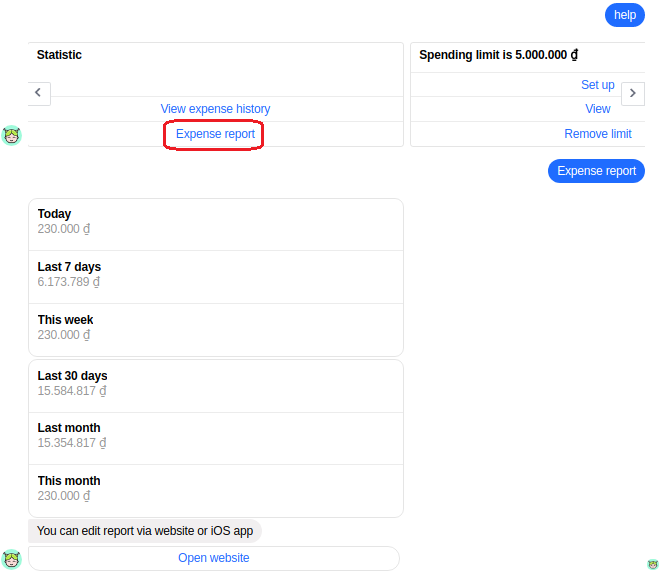

A budget app simplifies the process of tracking your expenses. With just a few taps on your smartphone, you can easily log and categorize your transactions. This allows you to see where your money is going, identify spending patterns, and make informed decisions about your spending habits.

2. Better Budgeting

Budgeting apps provide a streamlined platform for creating and managing your budget. You can set spending limits for different categories, allocate funds accordingly, and track your progress in real-time.

These apps often offer visual representations of your budget, such as charts or graphs, making it easier to understand and adjust your spending habits.

3. Financial Goal Setting

Setting financial goals is essential for long-term financial success. A budget app can help you define and track your goals. Whether you aim to save for a down payment on a house, pay off debt, or build an emergency fund, a budget app allows you to set specific targets and monitor your progress along the way.

4. Automatic Expense Categorization

One of the significant advantages of budgeting apps is their ability to automatically categorize your expenses. By linking your accounts, the app can analyze your transactions and assign them to appropriate categories. This saves you time and effort in manually categorizing each expense.

5. Real-Time Updates and Notifications

A budget app provides real-time updates on your financial transactions. You can receive notifications when you overspend in a particular category or when bills are due. These reminders help you stay on top of your financial obligations and make timely adjustments to your spending.

6. Financial Insights and Analysis

Budgeting apps offer valuable insights and analysis of your financial data. They generate reports and visual representations of your spending patterns, income sources, and saving habits.

This information allows you to identify areas where you can cut back, make more informed financial decisions, and work towards improving your financial situation.

7. Sync Across Multiple Devices

Most budget apps sync seamlessly across multiple devices, such as smartphones, tablets, and computers. This feature ensures that you have access to your financial information wherever you go. You can easily check your budget, track expenses, and review your progress no matter which device you are using.

Related articles:

- How to Make a Monthly Budget: A Step-by-Step Guide to Financial Planning

- Eating Healthy on a Budget: Practical Tips for Nourishing Your Body and Wallet

- A Step-by-Step Guide: How to Create a Budget for Effective Financial Management

- How to Budget Money on a Low Income: Practical Tips for Financial Management

8. Security and Privacy

Budget apps prioritize the security and privacy of your financial information. They use encryption and secure protocols to protect your data from unauthorized access. It’s important to choose a reputable app from a trusted source and review their security measures and privacy policies to ensure your information is safeguarded.

Conclusion

Taking control of your finances is vital for your financial well-being, and a budget app can be a valuable tool in this journey. It simplifies expense tracking, streamlines budgeting, assists in goal setting, provides real-time updates and notifications, offers financial insights and analysis, syncs across multiple devices, and ensures the security and privacy of your financial information.

With a budget app at your disposal, you can gain a clear understanding of your finances, make informed decisions, and work towards achieving your financial goals. Embrace the convenience and power of technology by incorporating a budget app into your financial routine, and experience the positive impact it can have on your financial journey.