Saving money is a key aspect of financial well-being and achieving your long-term goals. Whether you’re saving for a rainy day, a dream vacation, or financial freedom, adopting smart money-saving habits can make a significant difference. In this article, we will share top money-saving tips to help you maximize your savings and build a solid foundation for a brighter financial future.

1. Create a Budget

Start by creating a budget to track your income and expenses. This allows you to see where your money is going and identify areas where you can cut back. Allocate a specific amount for each expense category and ensure that you spend within your budget limits.

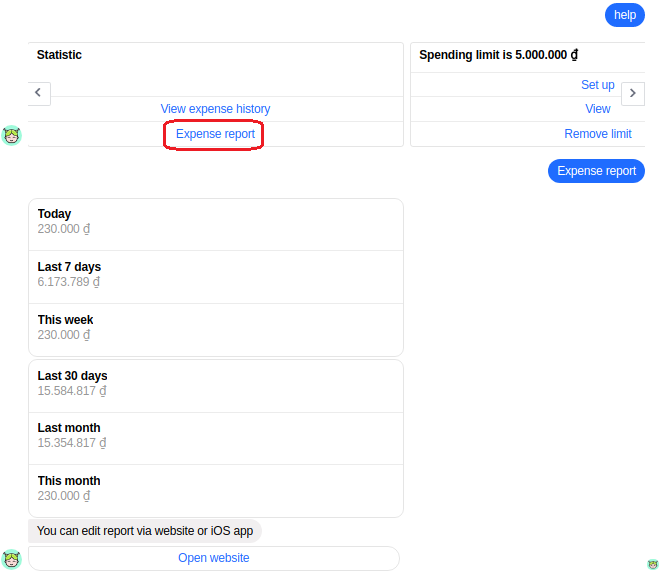

2. Track Your Spending

Keep a record of your expenses to gain a clear understanding of your spending patterns. Use mobile apps or spreadsheets to categorize your expenses and analyze where your money is being utilized. This insight will help you identify areas where you can make adjustments and save more effectively.

3. Prioritize Saving

Treat saving as a priority rather than an afterthought. Set a savings goal and commit to saving a portion of your income each month. Automate your savings by setting up automatic transfers from your checking account to a dedicated savings account. This ensures consistency and removes the temptation to spend the money earmarked for savings.

4. Cut Back on Discretionary Expenses

Identify discretionary expenses that you can reduce or eliminate. Review your entertainment choices, eating out habits, subscription services, and impulse purchases. Consider alternatives such as cooking at home, exploring free or low-cost entertainment options, and opting for generic or store-brand products to save money.

5. Comparison Shop

Before making a purchase, compare prices from different retailers, both online and offline. Take advantage of discounts, sales, and promotional offers. Additionally, use price comparison websites and apps to ensure you’re getting the best value for your money.

6. Embrace Energy Efficiency

Save money on utility bills by adopting energy-efficient practices. Turn off lights when not in use, unplug electronics, adjust thermostat settings, and use energy-saving appliances. These small changes can add up to significant savings over time.

7. Plan Meals and Limit Food Waste

Plan your meals in advance and make a shopping list accordingly. This helps you avoid impulse purchases and reduces the chances of buying unnecessary items. Additionally, make an effort to minimize food waste by utilizing leftovers creatively and storing food properly.

8. Negotiate Bills and Expenses

Don’t be afraid to negotiate bills and expenses such as insurance premiums, cable or internet bills, and credit card interest rates. Contact service providers, explain your situation, and inquire about available discounts or better offers. Negotiating can result in substantial savings over time.

9. Build an Emergency Fund

Establishing an emergency fund is crucial for unexpected expenses and financial stability. Aim to save three to six months’ worth of living expenses. Start by setting aside a small amount from each paycheck and gradually increase it over time. Having an emergency fund protects you from relying on credit cards or loans during unforeseen circumstances.

10. Seek Out Free and Low-Cost Activities

Explore free or low-cost activities in your community for entertainment and leisure. Visit local parks, libraries, museums on free admission days, and attend community events. Engaging in affordable activities can help you save money while still enjoying a fulfilling lifestyle.

Conclusion

Adopting smart money-saving habits is essential for building a strong financial foundation. By creating a budget, tracking your spending, prioritizing saving, cutting back on discretionary expenses, comparison shopping, embracing energy efficiency, planning meals, negotiating bills, building an emergency fund, and seeking affordable entertainment, you can maximize your savings and achieve your financial goals. Remember, every small step you take towards saving money brings you closer to long-term financial security and the freedom to pursue your dreams.