Let me share you something!

I had a small talk with my friends recently. They asked me what Song Nhi app did for real and I told them that Song Nhi was a virtual assistant that can help them manage their personal finance. They reacted with a blank stare followed by, “I know nothing about personal finance.”

Honestly, it didn’t surprise me at all

Back then, six months ago, I was exactly “them”. The term “personal finance” was completely strange to me. How could it not be so? I grew up in a family that valued education and learning but didn’t talk about money. School didn’t teach that subject either. (Someone told me it was Maths. Really? Did you really think just because you were good at Maths, you knew all things about finance? Oh honey, wake up!). Yes, I never learned anything about personal finance growing up – not at home and not at school. And I’m very sure that many people have been in that situation too.

The truth is, though, personal finance is something that you really need to take control of

Imagine this scenario: You work for a company as an employee. Your salary is $500 per month. You are paying about $100 a month for an apartment. Not just that, you start wondering why you deny yourself a few pleasures in life – which you’ve worked hard for. Then, you go out to dinner, buy those new shoes you’ve had your eye on. At the end of the day, you’re broke. Obviously. Starting all over again. You have to think about how to earn money to cover your rent and still have enough leftover for other expenses. Your life become the cycle of living paycheck to paycheck. It was a pretty sorry existence. Go to work. Spend money. Think about how to make money. Go to work…

Is this the life you want to live? Of course not

So, to escape from that cycle, you should care, and you should take the time to make your finance a priority. Learning about personal finance gives you the knowledge and understanding to make smart money choices. And as a result, it will give you freedom in your life and the ability to accomplish your dreams. Even better, the sooner you start managing your personal finance, the bigger those benefits become.

Ok, that’s just a theory. How can we execute it in reality?

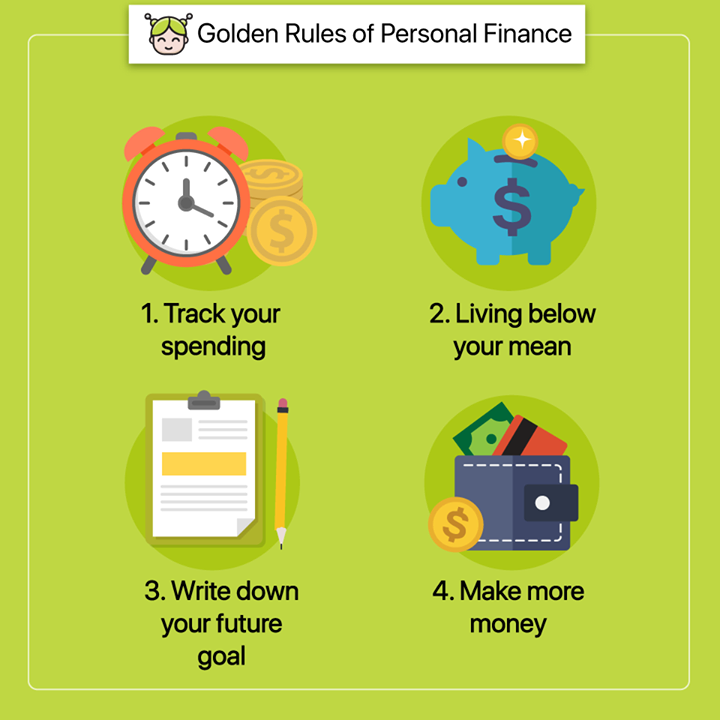

Without any further delay, here are 4 actionable steps you can take today to put yourself in a better financial position. If I can do it and my life is better now, there’s no reason why you can’t do the same.

1. Start actually figuring out where your money goes

Tell me the truth. Do you know how much you’re really spending each month? If the answer is “No”, you have a lot of work to do now.

Start with a pencil and paper, a spreadsheet or yes, a personal finance app, such as Song Nhi, which can help track your spending for you. You can track exactly where every dollar is going–from a small coffee on your way to work to a spending splurge at the mall.

Once you have an idea of how much money is flowing each month, you can have a picture of your behaviors to help you organize your spending and saving

2. Living below your mean

If you earn $500 per month and you spend $600 per month, you’ll always be broke.

Spending less than you earn allows you to control your spending – and make your money work for you. You can avoid getting into any more debt, prepare for the rainy days or any problems that life throws at you.

3. Write down your future goal

Where would you like to be in the next couple of years?

You want to save money for a dream trip? You’d like to buy a new house? What do you really want to achieve financially?

Write them down!

By setting a certain goal, you give your money a purpose. When you have a purpose, you can find ways to make it come true. If you take just one step toward your big goals every day, you’ll realize those goals weren’t really far away.

4. Make more money

Saving is a great way to get ahead but you should consider spending some time to start a side hustle that earns you extra money. Or you can invest in things that will earn you more money than you had before. Money can grow, you know!

And THAT my friends, is how you become rich. Take control of your own personal finance. Make your money make more money.

Then, if you ask me again what Song Nhi app really do. My answer is still the same. It is a virtual assistant that can help you manage your personal finance. But now, you did know something about personal finance! 🙂