In the realm of retirement planning, the question of whether one can retire comfortably on $500,000 is a topic of significant debate and consideration. In this comprehensive guide, we’ll delve into the intricacies of retirement savings, exploring the feasibility of retiring with $500,000 and providing insights for a professional audience.

Understanding Retirement Savings

Retirement savings play a critical role in ensuring financial security and independence during your golden years. The amount you save and the strategies you employ can significantly impact your retirement lifestyle and longevity of your funds.

Analyzing the $500,000 Retirement Scenario

Retiring with $500,000 requires careful planning and consideration of various factors, including:

Lifestyle Expectations

Your desired retirement lifestyle, including housing, healthcare, travel, and leisure activities, will dictate your financial needs.

Inflation and Cost of Living

Factoring in inflation and the rising cost of living is crucial for estimating future expenses and maintaining purchasing power.

Investment Returns

The rate of return on your investments, along with the asset allocation and risk tolerance of your portfolio, will impact the growth and sustainability of your retirement funds.

Healthcare Costs

Healthcare expenses, including insurance premiums, deductibles, and out-of-pocket costs, can have a significant impact on your retirement budget.

Social Security and Other Income Sources

Consideration of additional sources of income, such as Social Security benefits, pensions, or part-time work, can supplement your retirement savings and provide financial stability.

Strategies for Maximizing Retirement Savings

To make the most of your $500,000 retirement savings and ensure a comfortable retirement, consider the following strategies:

Create a Detailed Retirement Plan:

Work with a financial advisor to develop a comprehensive retirement plan tailored to your financial goals, risk tolerance, and time horizon.

Maximize Retirement Contributions:

Contribute the maximum allowable amount to tax-advantaged retirement accounts such as 401(k)s, IRAs, and HSAs to maximize tax benefits and retirement savings potential.

Diversify Your Investments:

Build a diversified investment portfolio consisting of stocks, bonds, real estate, and other assets to mitigate risk and enhance long-term growth potential.

Minimize Expenses:

Adopt frugal living habits and minimize unnecessary expenses to stretch your retirement savings further and maintain financial stability.

Consider Part-Time Work or Consulting:

Explore opportunities for part-time work, consulting, or freelance gigs during retirement to supplement your income and stay active professionally.

Related article:

(FAQs) About Retirement Savings

Is $500,000 enough to retire comfortably?

The adequacy of $500,000 for retirement depends on various factors, including your lifestyle expectations, healthcare needs, investment returns, and other sources of income.

While $500,000 can provide a comfortable retirement for some individuals, others may find it insufficient. Working with a financial advisor to assess your specific situation and develop a personalized retirement plan is crucial for determining whether $500,000 is enough for your retirement needs.

How long will $500,000 last in retirement?

The longevity of $500,000 in retirement depends on your withdrawal rate, investment performance, and lifestyle expenses. Using the 4% rule as a guideline, withdrawing 4% of your retirement savings annually, adjusted for inflation, is considered a sustainable approach for a 30-year retirement.

However, individual circumstances vary, and it’s essential to consider factors such as healthcare costs, inflation, and unexpected expenses when estimating the lifespan of your retirement savings.

What investment strategies are suitable for managing $500,000 in retirement savings?

Managing $500,000 in retirement savings requires a diversified investment approach tailored to your risk tolerance, time horizon, and financial goals. Consider allocating your portfolio across various asset classes, including stocks, bonds, real estate, and alternative investments, to mitigate risk and maximize long-term growth potential.

Should I consider delaying retirement if I only have $500,000 saved?

Delaying retirement can be a prudent strategy if you have $500,000 saved and are concerned about the adequacy of your retirement funds. Continuing to work allows you to boost your savings, delay Social Security benefits, and reduce the number of years you rely on your retirement savings.

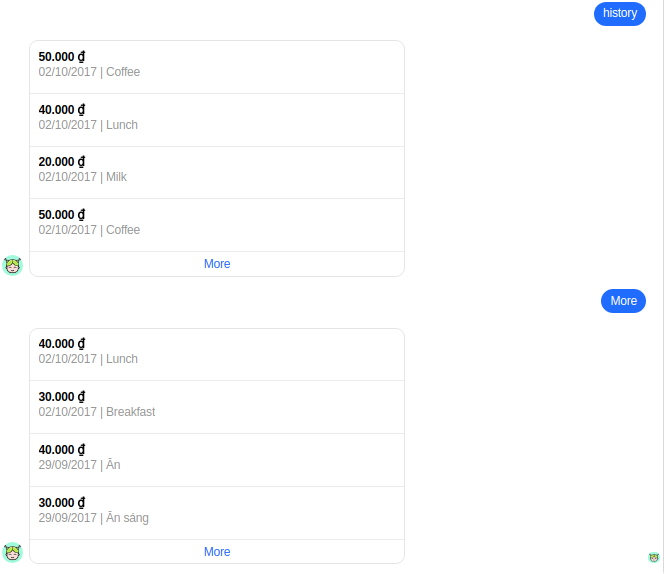

How can I maximize my retirement savings if I have limited funds?

If you have limited retirement savings, there are several strategies you can employ to maximize your retirement funds:

- Increase your retirement contributions: Contribute as much as possible to tax-advantaged retirement accounts such as 401(k)s, IRAs, and HSAs to maximize tax benefits and retirement savings potential.

- Minimize expenses: Adopt frugal living habits and minimize unnecessary expenses to stretch your retirement savings further and maintain financial stability.

- Consider alternative sources of income: Explore opportunities for part-time work, freelance gigs, or passive income streams to supplement your retirement savings and increase your overall financial security.

Conclusion: Planning for a Secure Retirement

While retiring with $500,000 presents challenges, it is possible to achieve a comfortable retirement with careful planning, disciplined savings habits, and strategic investment decisions. By understanding your financial needs, maximizing savings opportunities, and adopting prudent financial strategies, you can embark on a fulfilling retirement journey with confidence and peace of mind.

In conclusion, the path to retirement success lies in proactive planning, diligent saving, and prudent decision-making. With the right approach and professional guidance, you can retire comfortably on $500,000 and enjoy the fruits of your labor for years to come.