A business bank account is an essential financial tool for any business, regardless of its size or structure. It provides a dedicated account to manage your business finances separately from personal finances, offering numerous benefits and simplifying financial management. In this article, we will explore why your business needs a bank account and provide guidance on how to get started.

Why Your Business Needs a Bank Account

1. Legal Separation

Maintaining a separate business bank account establishes a clear distinction between your personal and business finances. This separation is crucial for legal and accounting purposes, protecting your personal assets and simplifying tax reporting.

2. Professionalism and Credibility

Having a dedicated business bank account adds professionalism and credibility to your business. It demonstrates that you are serious about your operations and helps build trust with clients, suppliers, and financial institutions.

3. Financial Management

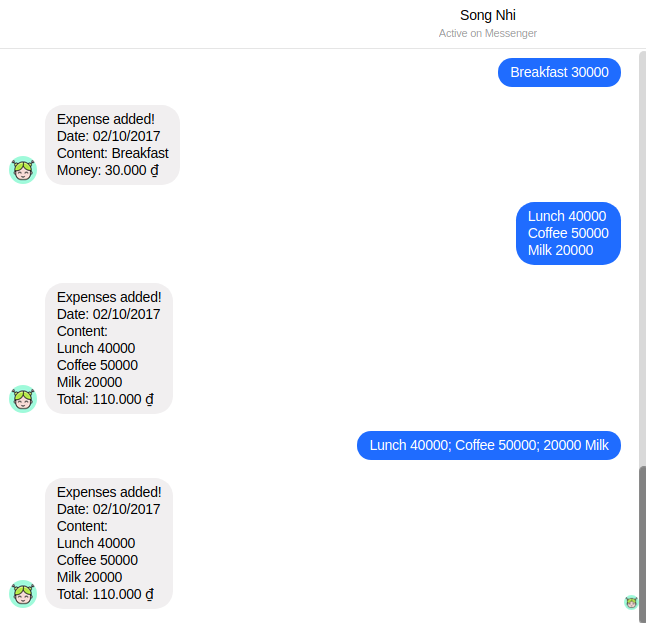

A business bank account makes it easier to manage your business finances. It provides a centralized location to track income and expenses, facilitating accurate record-keeping, budgeting, and financial analysis. With separate accounts, you can clearly see your business’s financial health and make informed decisions.

4. Payment Processing

A business bank account enables you to accept payments from customers through various channels, such as credit cards, debit cards, and electronic fund transfers. It simplifies the payment process, enhances customer convenience, and expands your sales opportunities.

5. Access to Business Banking Services

By having a business bank account, you gain access to a range of specialized banking services tailored to businesses. These services may include merchant services, business loans, lines of credit, payroll management, and cash management tools. Such services can help streamline operations and support your business’s growth.

How to Get Started with a Business Bank Account

1. Choose a Bank

Research and compare different banks to find one that aligns with your business’s needs. Consider factors such as fees, account features, accessibility (branch network and online banking), customer support, and additional services offered. Look for a bank with experience serving businesses similar to yours.

2. Gather Required Documentation

Contact your chosen bank to determine the specific documentation needed to open a business bank account. Generally, you will need:

- Business identification: Such as your business name, structure (sole proprietorship, partnership, corporation), and Employer Identification Number (EIN) or Tax Identification Number (TIN).

- Personal identification: Provide personal identification documents for all individuals associated with the business, such as passports or driver’s licenses.

- Business registration documents: Include copies of your business licenses, articles of incorporation, or partnership agreements.

- Proof of address: Provide documents verifying your business’s physical address, such as utility bills or a lease agreement.

- Additional documentation: Depending on your business type and banking requirements, you may need additional documents, such as financial statements or business permits.

3. Visit the Bank or Apply Online

Visit the bank branch or apply online, depending on the bank’s options. Complete the application form, providing accurate information and attaching the required documentation. If applying online, follow the bank’s instructions and provide digital copies of the necessary documents.

4. Review Account Terms and Services

Before finalizing the account opening, carefully review the terms and conditions of the business bank account. Understand the fees, transaction limits, online banking features, and other services offered. If you have any questions, consult with a bank representative for clarification.

Related articles:

- What Do You Need to Open a Bank Account: Essential Requirements and Documentation

- A Step-by-Step Guide on How to Close a Bank of America Account

- The Best Small Business Bank Account: Key Features & Considerations

- What Do I Need to Open a Business Bank Account? A Comprehensive Guide

Conclusion

Opening a business bank account is a critical step in managing your business’s financial affairs effectively. It provides legal separation, enhances professionalism, simplifies financial management, enables payment processing, and grants access to specialized business banking services.

Choose a bank that suits your business’s needs, gather the required documentation, and complete the application process. By having a dedicated business bank account, you can streamline your financial operations and lay a strong foundation for your business’s success.