Financial planning is a multifaceted process that requires careful consideration of various aspects of your financial life. Delving deeper into each of the five main areas of financial planning can provide valuable insights and strategies for achieving your financial goals. Let’s explore these areas in more detail:

1. Budgeting and Cash Flow Management

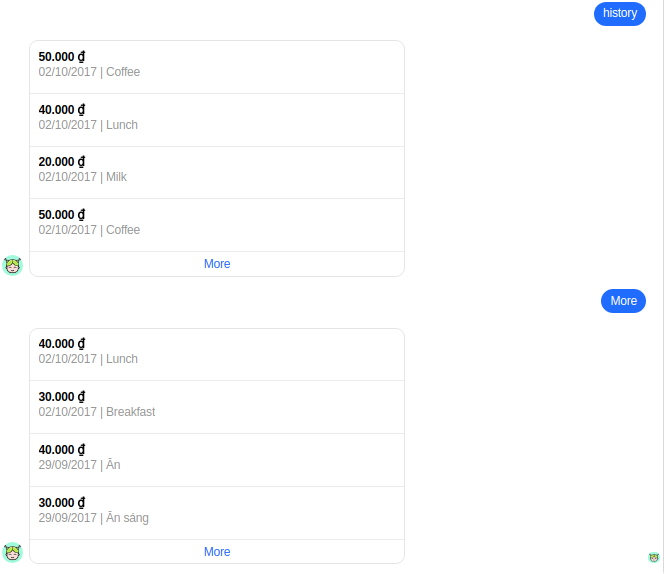

Budgeting goes beyond simply tracking income and expenses—it’s about understanding your spending patterns, identifying areas for improvement, and aligning your financial habits with your goals. Start by creating a detailed budget that outlines your monthly income and expenses.

Analyze your spending to distinguish between essential and discretionary expenses, and look for opportunities to reduce costs and increase savings. Implementing a cash flow management system allows you to allocate funds towards savings, debt repayment, and investments more efficiently, paving the way for long-term financial success.

2. Investment Planning

Investment planning involves developing a personalized investment strategy tailored to your financial objectives, risk tolerance, and time horizon. Diversification is key to mitigating risk and maximizing returns, so consider investing in a mix of asset classes such as stocks, bonds, mutual funds, and real estate.

Regularly review and adjust your investment portfolio to ensure it remains aligned with your goals and risk profile. Additionally, educate yourself about different investment options and strategies to make informed decisions and optimize your investment returns over time.

3. Retirement Planning

Retirement planning is a critical component of financial planning, as it involves preparing for your financial needs during retirement. Start by estimating your retirement expenses, taking into account factors such as healthcare costs, inflation, and lifestyle preferences.

Determine your retirement income sources, including Social Security benefits, pensions, retirement accounts, and other investments. By contributing regularly to retirement accounts such as 401(k)s, IRAs, or Roth IRAs, you can build a substantial nest egg to support your desired lifestyle in retirement.

4. Risk Management and Insurance

Risk management is essential for protecting your financial well-being against unexpected events that could derail your financial plans. Evaluate potential risks such as illness, disability, property damage, or premature death, and implement strategies to mitigate these risks effectively.

Insurance products such as health insurance, life insurance, disability insurance, and property insurance provide valuable protection against financial losses due to unforeseen circumstances. Review your insurance coverage regularly to ensure it remains adequate and up-to-date based on changes in your circumstances and needs.

5. Estate Planning

Estate planning involves organizing and managing your assets to ensure they’re distributed according to your wishes after you passing. Start by creating essential estate planning documents such as wills, trusts, powers of attorney, and healthcare directives.

Designate beneficiaries for your assets and review beneficiary designations regularly to ensure they align with your intentions. Minimize estate taxes and streamline the transfer of assets to your heirs by implementing estate planning strategies such as gifting, charitable giving, and asset protection trusts.

Related article:

- The Five Basic Elements of A Budget

- 10 Reasons Why Financial Planning Is Important

- How to Make a Monthly Budget

- Why You Need a Budget App

Conclusion

By focusing on each of these five main areas of financial planning, you can develop a robust financial plan that provides clarity, direction, and peace of mind. Remember that financial planning is an ongoing process that requires regular review and adjustment to accommodate changes in your life circumstances and financial goals. With dedication, discipline, and strategic planning, you can build a solid foundation for long-term financial success and security.