Financial planning plays a crucial role in achieving long-term financial stability and security. Whether you’re saving for retirement, managing debt, or planning for major life events, effective financial planning can help you navigate your financial journey with confidence. Here are ten reasons highlighting the importance of financial planning:

1. Establish Clear Financial Goals

Financial planning allows you to define clear and achievable financial goals, whether it’s buying a home, saving for education, or building a retirement nest egg. By setting specific objectives, you can create a roadmap for your financial future and track your progress along the way.

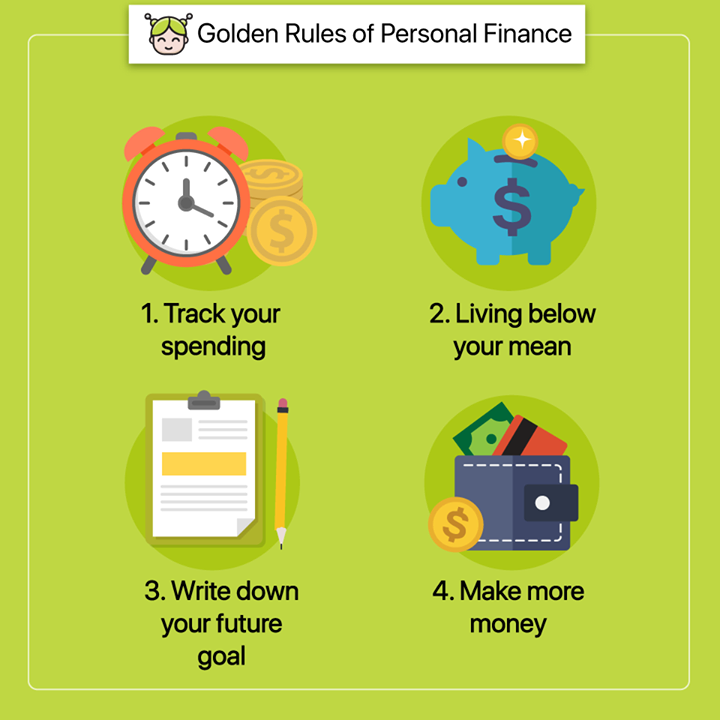

2. Budgeting and Expense Management

A key aspect of financial planning is creating a budget that aligns with your income and expenses. Budgeting helps you manage your cash flow effectively, control spending habits, and allocate resources towards your priorities, such as debt repayment or savings goals.

3. Emergency Preparedness

Financial planning involves preparing for unexpected emergencies, such as medical expenses, job loss, or home repairs. By building an emergency fund as part of your financial plan, you can weather financial shocks without derailing your long-term goals.

4. Debt Management

Effective financial planning includes strategies for managing and reducing debt. Whether it’s credit card debt, student loans, or mortgages, having a plan in place to pay down debt can alleviate financial stress and pave the way for future financial growth.

5. Wealth Accumulation

Financial planning enables you to build wealth over time through disciplined saving and investing. By identifying opportunities for growth and maximizing returns on your investments, you can accumulate wealth and work towards financial independence.

6. Retirement Planning

One of the primary goals of financial planning is preparing for retirement. By estimating future expenses, assessing retirement income sources, and creating a retirement savings plan, you can ensure a comfortable and secure retirement lifestyle.

7. Tax Efficiency

Strategic financial planning involves optimizing your tax strategy to minimize tax liabilities and maximize savings. By taking advantage of tax-advantaged investment accounts, deductions, and credits, you can optimize your tax situation and keep more money in your pocket.

8. Risk Management

Financial planning encompasses risk management strategies to protect against unforeseen events that could jeopardize your financial security. This includes insurance coverage for health, life, disability, and property to mitigate potential risks and safeguard your assets.

9. Legacy Planning

Financial planning extends beyond your lifetime and includes considerations for legacy planning. By creating an estate plan, including wills, trusts, and beneficiaries, you can ensure your assets are distributed according to your wishes and provide for future generations.

Related articles:

- How to Budget Money on a Low Income?

- How to Create a Budget for Effective Financial Management

- Eating Healthy on a Budget

- How to Make a Monthly Budget?

10. Peace of Mind

Perhaps the most significant benefit of financial planning is the peace of mind that comes from knowing you’re in control of your financial future. By having a comprehensive plan in place, you can reduce financial stress, achieve your goals, and enjoy greater financial well-being.

In conclusion, financial planning is essential for achieving financial success and security at every stage of life. Whether you’re starting your career, raising a family, or planning for retirement, effective financial planning can help you navigate life’s financial complexities and build a brighter future for yourself and your loved ones.